Liquidity mining crypto, also known as ‘pump-and-dump coins are cryptocurrencies that have what seems to be extremely low trading volume compared to their overall market capitalization.

Liquidity coin

Once an online coin has been identified as a liquidity coin, the crypto community will sell all of their assets in said currency while simultaneously promoting it through various mediums such as blogs, social media, YouTube videos, etc. The key factor here is to make sure you buy low and sell high. This, of course, only increases the liquidity mining effect as more people become involved in the new cryptocurrency who were not aware it was a “pump-and-dump” coin.

Possible reasons why new coins are chosen for liquidity mining are, but are not limited to:

– New coins have low volume in relation to their market cap

– Coin may seem undervalued

– A new coin with a unique concept, offering an innovative service, etc. announced

– An innovative way of advertising a new coin presented (e.g., Bitcointalk, traditional media, and social media).

Pump and dump groups

Pump and dump groups buy low and sell high after creating hype around an unknown coin in order to increase the demand while at the same time decreasing supply, thus creating a vacuum that interested parties easily fill.

Once the price of the coin has risen high enough. And once most of the coins have already been bought by the pump and dump group, they sell their coins to interested parties who believe that they’ve entered a rising market.

The result is that these new buyers will be left holding the bag and that the groups behind this scheme have made a profit at the expense of those hosting their miscalculations.

The pump and dump scheme has been around for decades and can be found within popular cultures. Such as movies like Boiler Room or Wolf of Wall Street, and has always been a problem in traditional markets. Therefore, it should come as no surprise that this method will exist in the still-young world of cryptocurrency trading.

Similar to other pump-and-dump schemes, the pump-and-dump cryptocurrency scheme is perfectly legal despite it being against the best interests of other investors.

The crypto community has come up with a number of ways to attempt to stop these groups from succeeding in their endeavors. By using ‘pump and dump’ filters in popular trading software such as Telegram or Discord and through various Telegram groups that attempt to beat the system. For example by buying into a coin that’s currently being ‘pumped’. And then waiting until it’s finished pumping before selling again.

The best method of preventing any losses from occurring is to invest in coins based on their long-term potential. Thus making sure you’re not caught sinking when the next pump-and-dump coin pops up on your radar.

Liquidity pool meaning

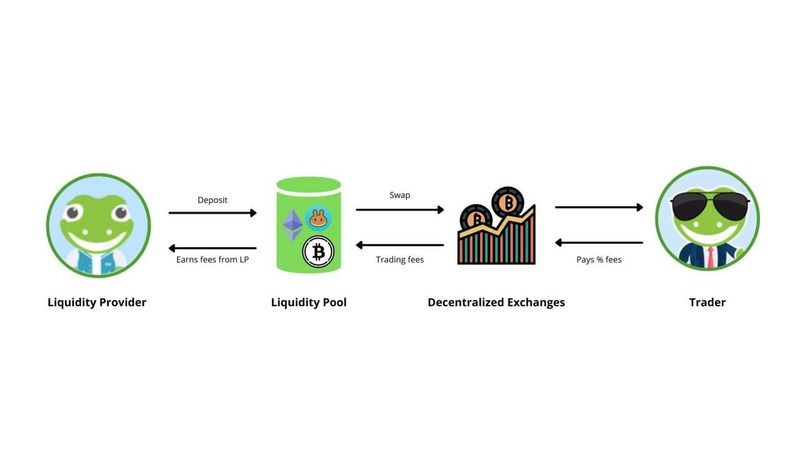

A liquidity pool meaning is a place where many investors put their assets to earn profit. The liquidity pool also called Liquidity Mining (LM). This is a crypto community mining activity that has the objective of increasing the market value of coins. Under the condition that the coin price increases, all investors will gain profit from it. LM could be done with a regular computer, but nowadays, most people use a cloud mining service to increase profit.

LM works by pooling together your assets and using that to buy a single asset. When the price of this single asset increases, each investor will gain profit from it. The more money they have pooled together, the bigger their chance to earn more profit from LM activity.

LM example: A trader has 3 BTC and wants to increase the market value by buying a new coin (assume that this coin is in its Initial Coin Offering phase, and the price of one unit is 0.1 BTC). They then sell all three of their bitcoins into this newly bought coin. Since the coin price increased to 0.2 BTC, they then sold it into bitcoin again. And since the price of this coin is now worth 0.4 BTC. This trader will earn a profit of 2BTC from LM activity.

Authenticity proof meaning

Authenticity proof means digital evidence that proves the existence of a certain message or file. It’s a method to show that a certain event or message is not a one-time, double spending, or any other type of fraudulence.

Authenticity proof in coin LM activity: Suppose five investors have put their assets together to buy a new asset. This means that investor A has 1 BTC. Secondly, investor B has 2 BTC. Then, investor C has 3 BTC. Investor D has 4 BTC. And investor E has 5 BTC. This LM activity is completed when investors B to E vote the transaction of selling the new asset into bitcoin as ‘true.’ The authenticity proof is a message signed by this group of investors with their private key. It shows that they have put together their assets and support this LM activity.

Crypto liquidity mining is very popular nowadays. Because it’s a way to earn money without having to put in much effort at all. But it can be a hazardous method that should never be attempted by someone who doesn’t know what they’re doing. As always, do your research before investing in anything and only put in as much as you are willing to lose.